Eligibility of costs

Please refer to the financial guidelines Horizon 2020 Annotated Model Grant Agreement (AMGA) for the full set of financial requirements for your EC project.

Click the drop-down links below to find out about key requirements for these projects:

Personnel

We can declare the following types of costs as ‘direct personnel costs’:

- costs for employees (or equivalent)

- costs for natural persons working under a direct contract

- costs for personnel seconded by a third party

- costs for beneficiaries that are SMEs for their owners not receiving a salary

- costs for beneficiaries that are natural persons not receiving a salary

- personnel costs for providing trans-national or virtual access to research infrastructure (if option applies)

Personnel costs must be limited to basic salary (including during parental leave), social security contributions, taxes and other costs included in the remuneration, if they arise from national law or the employment contract (or equivalent appointing act).

- For those working exclusively for the EC action (i.e. 100% of their contracted hours) their costs are charged directly to the project. When we report to the EC we claim the total costs charged to the project as part of our financial reporting. All employees working exclusively for an EC project must complete a declaration of exclusivity at the end of each reporting period.

- For those who do not work exclusively for the action (i.e. they split their time amongst various projects/activities), we can only claim for the time spent working on the EC action. It is essential that the total number of hours worked for the action are recorded using timesheets to allow us to calculate the correct costs for these employees.

Evidencing personnel costs, secondments & recording absences

Evidencing salary costs: timesheets and declaration of exclusivity

In order to provide supporting evidence for salary costs on EC projects, beneficiaries must keep accurate time records for all personnel costs. Timesheets must be completed on a monthly basis by the individual staff member and then sent to the Faculty Research and Innovation Office (FRIO) to check; the FRIO will then arrange for the timesheets to be authorised and retained for reporting.

Please note, we will not be able to claim for any personnel costs which do not have the necessary supporting documentation.

The AMGA states the following:

1. For persons who do NOT work exclusively for the action, the beneficiaries must show the actual hours worked, with reliable time records (e. time-sheets) either on paper or in a computer-based time recording system.

Time records must be dated and signed at least monthly by the person working for the action and his/her supervisor.

Time records should include, as a minimum:

- the title and number of the action, as specified in the GA

- the beneficiary’s full name, as specified in the GA

- the full name, date and signature of the person working for the action

- the number of hours worked for the action in the period covered by the time record;

- the supervisor’s full name and signature

- a reference to the action tasks or work packages of Annex 1, to which the person has contributed by the reported working hours.

2. For persons who work exclusively for the action (regardless if they are full-time or part-time employees), the beneficiary may either:

a) sign a declaration on exclusive work for the action (one per reporting period), to confirm that the person worked exclusively for the action, either:

- during the whole reporting period

or - during an uninterrupted time-period, covering at least a full natural month within the reporting period.

Intermittent (i.e. sporadic or random) periods of ‘exclusive’ dedication can NOT be subject of a declaration. If a person worked randomly for the action after an uninterrupted time-period covered by a declaration, time records are needed for the period of random work.

b) keep time records in accordance with the guidance above for those who do not work exclusively for the action.

N.B We ask those who work exclusively for the action to also keep timesheets as this provides us with additional supporting evidence should this be requested during an audit.

For more information, please consult our complete guidance on how to complete timesheets and declarations of exclusivity with the timesheet template to use.

If you are working on more than one EU project, please use the timesheet for multiple EU projects.

Please consult our guidance on how to calculate staff costs along with a copy of the DACS reconciliation sheet.

Secondments

‘Seconded’ means the temporary transfer of personnel from a third party to the beneficiary. The seconded person is still paid and employed by the third party, but works for the beneficiary. S/he is at the disposal of the beneficiary.

Secondments should be formalised via a secondment agreement. The secondment agreement has to detail the conditions of secondment (tasks, payment (or not) from one entity to the other, duration of the secondment, location, etc.).

A secondment normally requires the seconded person to work at the beneficiary’s premises, although in specific cases it may be agreed otherwise in the secondment agreement.

We must reimburse the actual costs to the third party (based on the same hourly rate calculations as our own employees if they aren’t working exclusively for the project) and must request supporting documentation in case of audit i.e. payroll data and timesheets/declaration of exclusivity.

Recording absences

It is a requirement at audit that information included in timesheets must match records of annual leave, sick leave and other leaves. This is still proving problematic so if you are in receipt of EC funding for any of your time you must use the SAP/Self-Service system to record your periods of annual/sick leave.

Travel

All travel must be project related and must be reimbursed in line with our usual accounting practices.

Travel and subsistence costs must relate to University of Leeds personnel, as Leeds is the beneficiary of the EC award. They may also relate to experts that participate in the action on an ad hoc basis (e.g. attending specific meetings), if:

- the experts’ participation is foreseen in Annex 1;

or - their participation is specifically justified in the periodic technical report and the Commission/Agency approved it without formally amending the GA (simplified approval procedure).

Evidence must be kept linking the travel to the EC project i.e. minutes of the meeting, agenda, presentations or attendance records.

It is a requirement at audit that information included in timesheets must match travel records (e.g. expense forms) therefore it is crucial that any travel undertaken as part of the EC project is correctly reflect on the project timesheets.

Equipment

This budget category covers the depreciation costs of capital equipment, infrastructure or other assets used for the action.

Whilst our depreciation policy is that any equipment (cost of >£25K) purchased specifically for research grants depreciate completely over the life of the project, we still have to calculate a pro rata value for the amount we can claim in each reporting period based on the ‘date of first use’ until the end of the project.

We must also be able to evidence that the equipment has been used exclusively for the project and not for any other activities. This can either be in the form of usage records, such as log books, electronic sign in etc. or via a declaration confirming exclusive use. This will be requested at each reporting period.

Please ensure our usual accounting processes for purchasing capital equipment are followed at all times and that all costs are supported by the necessary procurement procedures i.e. thresholds, quotes, tenders etc.

Other goods and services

This budget category covers the costs for goods and services that are purchased for the project, including:

- costs for consumables and supplies (e.g. raw materials etc.)

- dissemination costs (including regarding open access to peer-reviewed scientific publications, e.g. article processing or equivalent charges, costs related to open access to research data and related costs, such as data maintenance or storage and conference fees for presenting project-related research)

- costs related to intellectual property rights (IPR) (including costs to protect the results or royalties paid for access rights needed to implement the action)

- costs for certificates on financial statements (CFS)

- translation costs (if translation is necessary for the action’s implementation)

Please ensure our usual accounting processes for purchasing other goods and services are followed at all times and that all costs are supported by the necessary procurement procedures i.e. thresholds, quotes, tenders etc.

Internally invoiced goods and services

This budget category covers the costs for goods and services which the beneficiary itself produced or provided for the action. At the University of Leeds this budget heading covers costs for the following services:

- TRAC-recognised facilities (TRFs)

- Internal catering

- Print and Copy Bureau

- Car Parking

- Post room

For these costs to be eligible, they have to costed in line with our usual accounting procedures and it must be the usual practice of the beneficiary to calculate a unit cost for that good or service. This is to ensure that no ineligible costs have been included in the costing e.g. indirect costs, profit margins. There are certain cost elements of our TRF costings which are ineligible according to the EC and must be excluded from our financial claims. These are:

- Equipment Depreciation

- Space Charges

- Double indexation

The rest of our internal departments tend to charge a price for their service and cannot provide this breakdown of costs. We therefore advise our PI’s to use external services only to ensure any costs we pay for can be claimed back from the EC.

TRAC-recognised facilities

For audit purposes we need to have the TRAC costing sheets, along with clear supporting evidence supporting the costs included in the costing (e.g. personnel, non-staff costs, unit rate). We also have to provide clear supporting evidence confirming the total usage relating to the project (e.g. logbooks, electronic timesheets/diary entries, booking logs etc).

More detailed guidance regarding evidence needed for audit can be found here

Third party engagement in H2020

As a general rule beneficiaries (those who sign up to the EC GA) should normally have the technical and financial resources to implement the EC project themselves.

The EC are very strict on what work can and cannot be done by staff not employed by the University so unless this has been included in the Description of Work all potential subcontracts/third party work should be approved by the EC before any payments are made. Before engaging with any third parties, not listed in your GA, please contact the EU Post Award team for further guidance.

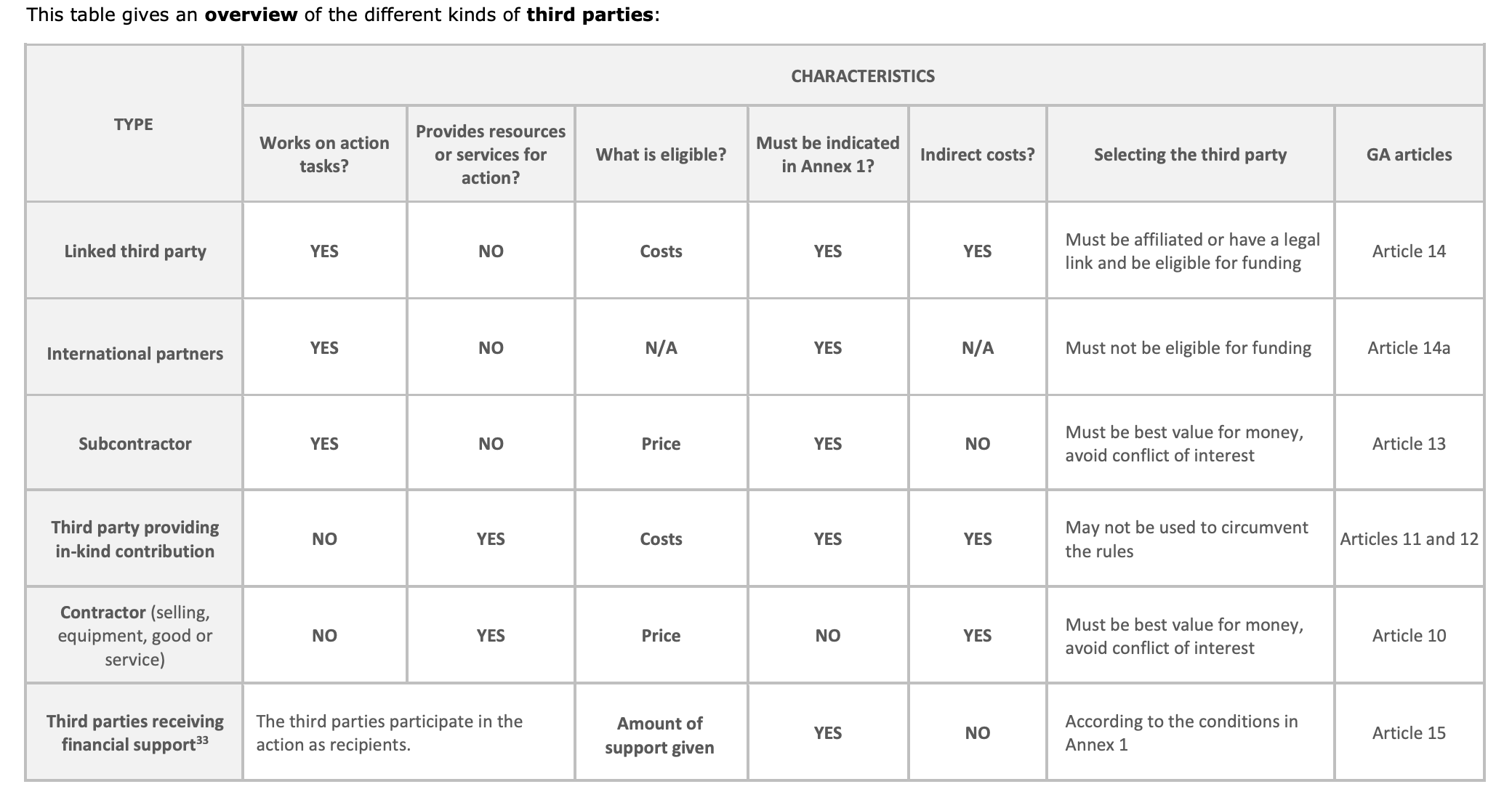

If it is necessary for the project beneficiaries can involve third parties in the following way:

- purchase goods, works and services (see Article 10 of the AMGA);

- use in-kind contributions provided by third parties against payment (see Article 11);

- use in-kind contributions provided by third parties free of charge (see Article 12);

- call upon subcontractors to implement action tasks described in Annex 1 (see Article 13);

- call upon linked third parties to implement action tasks described in Annex 1 (see Article 14);

Third parties do not sign the EC Grant Agreement however in all instances there should be some form of contractual relationship between the Third Party and the beneficiary, evidence of which must be kept in case of audit.

This table gives an overview of the types of third parties and their main characteristics. It is helpful to determine how you can engage with various external parties.

Please consult our detailed guidance regarding the types of third parties, and how they are categorised.